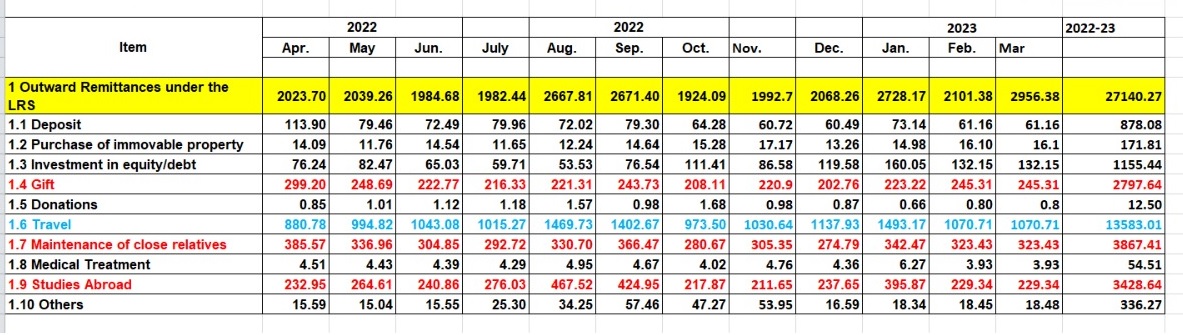

Recent data from the Reserve Bank of India (RBI) shows that Indian high-net-worth individuals (HNIs) remitted a total of US$27 billion out of India in the financial year 2022-23. This is a significant increase from the previous year’s figure of US$19.5 billion.

The RBI data shows that the majority of this remittance was used for foreign travel (US$13.5 billion), followed by education (US$10 billion) and gifts to relatives (US$3 billion). Only a small portion of the remittance (US$2 billion) was invested in foreign assets, such as equity, debt, and real estate.

This data raises the question of whether Indian HNIs are managing their wealth properly. On the one hand, the high level of remittance suggests that Indian HNIs are confident in the Indian economy and are willing to spend their money on foreign goods and services. On the other hand, the low level of investment in foreign assets suggests that Indian HNIs are not taking advantage of the opportunities available in global markets.

There are a number of possible explanations for this discrepancy. One possibility is that Indian HNIs are simply not aware of the investment opportunities available outside of India. Another possibility is that they are concerned about the risks associated with investing in foreign markets. Finally, it is also possible that they are simply not comfortable with the idea of investing their money outside of India.

Whatever the reason, the RBI data suggests that Indian HNIs have a significant opportunity to improve their wealth management. By investing in foreign assets, they can diversify their portfolios and protect their wealth from the risks associated with a single currency. They can also take advantage of the higher growth rates and lower taxes that are often available in foreign markets.

The RBI data is a wake-up call for Indian HNIs. It is time for them to start thinking about their wealth management in a more globalized way. By investing in foreign assets, they can improve their financial security and ensure that their wealth lasts for generations to come.

In addition to the reasons mentioned above, there are a few other factors that may be contributing to the low level of investment by Indian HNIs in foreign assets. These include:

· Lack of information and resources: Indian HNIs may not have access to the same level of information and resources as their counterparts in developed countries. This can make it difficult for them to identify and evaluate investment opportunities in foreign markets.

· Regulatory hurdles: The Indian government has put in place a number of regulatory hurdles that make it difficult for Indian HNIs to invest in foreign assets. These hurdles can add to the cost and complexity of investing and can discourage some HNIs from investing altogether.

· Taxation: Indian HNIs are subject to a number of taxes on their foreign investments. These taxes can erode the returns on their investments and can make it less attractive to invest in foreign assets.

The RBI data highlights the need for the Indian government to take steps to make it easier for Indian HNIs to invest in foreign assets. This could include providing more information and resources to HNIs, reducing regulatory hurdles, and simplifying the tax regime. By taking these steps, the government can help Indian HNIs to improve their wealth management and protect their wealth from the risks associated with a single currency.