The provisions in the New EB5 Reform and Integrity Act will allow investors to make investments in Regional Center EB-5 projects with more confidence.

These are FAQs on new New EB5 Reform and Integrity Act effective 15th March 2022 to 30th September 2027

- What are the new EB-5 rules that came into effect in March 2022?

Ans: Under new EB-5 rules, the investment amount has increased from US $500,000 to US $800,000 for rural areas, high unemployment areas or an infrastructure project. The amount has been increased from US $1,000,000 to US $1,050,000 for any other area and any other project /business. In either case, the investment must be made into a new business entity and must create at least 10 jobs for Americans.

- For what period of time will this new rule be applicable?

Ans: The new rules are effective for a period of five years, that is, until 30th September 2027.

- How will this new rule affect my pending EB-5 petition?

Ans: The new EB-5 rules provide for grandfathering of pending petitions, meaning that all pending EB-5 petitions will not be affected by these new rules. The EB-5 program is reauthorized until September 30th, 2027. The pending petitions will continue to be processed even after this date in the event the outcome of the petition is not decided.

- What is a rural area?

Ans: In general, an area with a population of less than 20,000 people as per the latest US census is termed as a rural area.

- What is a high unemployment area?

Ans: An area is designated by the Secretary of Homeland Security as a high unemployment area when unemployment is 150 per cent of the national average unemployment rate.

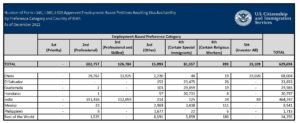

- Is there any quota for EB-5-based Green Cards in the USA?

Ans: Yes, there is an annual quota of 10,000 Green Cards per year. From this quota, 20% is reserved for rural areas, 10% for high-unemployment areas and 2% for infrastructure projects.

- Who decides if an area is a high unemployment area?

Ans: Only the Secretary of Homeland Security or a designee of the Secretary can determine if an area can be designated as a high unemployment area. The federal, state or local government does not have the authority to designate a high unemployment area.

- What is an infrastructure project and who determines which projects are infrastructure projects?

Ans: An ‘infrastructure project’ means a capital investment project in a filed or approved business plan, which is administered by a governmental entity (such as a Federal, State, or local agency or authority). The Secretary of Homeland Security or a designee of the Secretary will determine if a project is an infrastructure project or not.

- Will there be a rise in the EB-5 investment amount in the near future?

Ans: Under new rules, the EB-5 investment amount will increase every five years as per the consumer price index. The next revision will be on or after 1st January 2027.

- I am in the US on legal status, so when can I file for an EB-5 petition (I 526) and an adjustment of status (I 485) petition?

Ans: Under the new rules, any foreign national who is on a legal visa status may file a petition for EB-5 and adjustment of status at the same time. In other words, you can file for I 526 and I 485 at the same time.

- Under new rules how will “indirect job creation” be calculated”?

Ans: Under new rules, only 90% of the estimated indirect job creation will be considered for job creation and if it is indirect job creation in a real estate project, then only 75% of the estimated jobs will be considered for job creation.

- Is there record-keeping and audits for regional centres under the new rules?

Ans: Yes, under the new rules, regional centres are required to keep a record for a period five years after the last transaction is made and also undergo an audit every five years.

- Are projects promoted by regional centres approved by the US government?

Ans: Under new rules, each regional centre must pre-approve its project before it raises funds and before investors file an I-526 petition. Under the old rules, it was voluntary for the regional centres to obtain pre-approval of the project.

- Who can own, run, manage and operate a regional centre?

Ans: Only Green Card holders and American citizens can get involved in owning, managing and operating a regional centre provided – the person has a clean criminal record, does not have any ongoing criminal cases pending against him/her, has never been convicted of any crime such as securities law violations, illegal trafficking of contraband substances and such other violations. Additionally, no foreign government or entity can get involved in a regional centre.

- Are persons working for and affiliated with a regional centre subject to any law?

Ans: Under new laws, not only owners but also promoters, directors, managers, employees, associates, marketing agents and other associated personnel of a regional centre must remain in compliance with SEC regulations and other regulations made in this regard.

- What is EB–5 INTEGRITY FUND under the new rules?

Ans: Each regional centre is required to pay US $20,000 and US $10,000 (if the regional centre has less than 20 investors per year) in the EB–5 INTEGRITY FUND. An additional fee of US $1,000 per investor is required to be paid in addition to I -526 petition fees. This fund will be used for the purpose of management, audit, investigation, site visits, investor awareness, maintaining the integrity of the program and monitoring compliance with the requirements under section 107 of the EB–5 Reform and Integrity Act of 2022.

- Do EB-5 direct and third-party promoters (migration agents overseas) need to meet any compliance requirement with USCIS and/or SEC?

Ans: Each regional centre will be required to register their marketing agents, migration agents and such other affiliates with USCIS with their contact details, any signed agreement and fees contract. Promoters will also be required to certify that they are in compliance with the guidelines for third-party promoters; promoting the EB-5 project in compliance with the guidelines provided for the project and also for the visa process.

- Are there any changes to the source of fund requirement?

Ans: Under new rules, the investor must demonstrate a legitimate source of funds not only for the investment amount but also for any administrative fees paid to the regional centre.

- What if my regional centre does not comply with US regulations and is sanctioned or closed down?

Ans: Under the new rules, if the foreign investor has made an investment in good faith in a regional centre and for any reason the regional centre is TERMINATED OR DEBARRED, it will not have an effect on the EB-5 petition of the foreign investor. The investor will not lose the priority date if the amendment to the business plan and removal of conditions is filed within 180 days of the notification received from the government for the termination of RC.

- How will my money be invested in an EB-5 project?

Ans: The investment amount will be transferred to a separate account maintained by the regional centre. It will be transferred to the project only when it is certified by designated FUND MANAGERS (such as a public accountant, attorney, broker-dealer, investment advisors, etc.)

NOTE: In order to protect investors, various checks and balances have been introduced in the new EB–5 Reform and Integrity Act of 2022. Please refer to the full text of the Act for details.

This is a very simplified FAQ for a general understanding of the new EB-5 Reform and Integrity Act. You are advised to refer to the complete text of the ACT or consult a qualified attorney for more information.

About Ajmera Law Group:

Ajmera Law Group (ALG) is an Indian law firm that assists Indian students and parents to plan for their or their child’s foreign education and subsequent settlement in a foreign country by offering various options including Residency and Citizenship by Investment and/or global investment.