Insightful tips for parents wanting to send their children to study in the U.S. | obtain USA green card and eventual citizenship

Introduction:

The economic policy of India has been progressive since 1993 for inbound investment, and from 2007 onwards for outbound investment and remittance. As for outbound investment, the first wave of investment was by Indian multinationals who had the financial means and resources to invest outside of India.

The introduction of the Liberalized Remittance Scheme (LRS) generated opportunity and facilitated the entry of Indian SMEs into the outbound investment arena. This was the second wave of investors.

What we are witnessing in recent times is the third wave of investors comprising of Indian HNIs and UNHIs who are investing outside of India. As per the Reserve Bank of India (RBI), this investment/remittance amount was $19 billion US last year alone.

It is obvious that Indian multinationals are well served by top Indian and global professionals due to the size of the deal and investment made.

However, when it comes to Indian SMEs, Start-Ups and HNIs, professional help may not always be forthcoming and if available, may not be erudite. Investing outside of one’s country requires in-depth knowledge not only of the laws, rules and regulations governing such investments, but also the economic and financial climate of the destination of the investment and the various investment opportunities this destination has to offer.

It is with this objective that we are starting this monthly “How and Why to invest in ….” series, wherein we will be taking a closer look at the different investment destinations around the world.

We start this month with one of the most favored investment destinations for Indians – The United States of America.

- Why do Indian HNIs regard the USA as a favoured investment destination?

ANS: USA is unquestionably the largest economy in the world. The U.S. has retained its position of being the world’s largest economy since 1871. The size of the U.S. economy was at $20.58 trillion in 2018 in nominal terms and is expected to reach $22.32 trillion in 2020.

The U.S. is often dubbed as an economic superpower and that’s because the economy constitutes almost a quarter of the global economy, backed by advanced infrastructure, technology, and an abundance of natural resources.

The second reason why the U.S. is an economic powerhouse is because a majority of consumer brands created in the USA are household names globally. This makes people to look at the USA more favourably than other countries. The notion of the “American Dream’ and “Rags to Riches” stories of many of its wealthy citizens is also a great crowd puller.

The third most important aspect is the American education system. American universities and colleges attract the largest number of students from all over the world. As an after-effect, many parents of these students and business persons follow their children to make investments in the USA.

I believe this is what makes the USA a very desirable and favourable destination for Indian HNI parents and businesspersons for investment purposes as compared to other countries.

- In what type of asset classes can one invest in the USA?

ANS: USA is a free economy and one can make investment in all types of asset classes and businesses as long as it does not constitute an illegal activity. One question I am often asked is if Indians can purchase agricultural land in the USA. The simple answer is, “YES”. Foreigners can certainly purchase agricultural land in the USA.

One important note: When investing in the USA, one needs to consider the Indian legal perspective too; the types of assets Indian citizens are allowed to invest in, as well as the U.S. laws governing these investments.

For example, if an Indian citizen decides to invest in a U.S. Green Card under the EB-5 category, he/she needs to follow Indian laws regarding remittance of money and the U.S. immigration laws which govern this type of investment.

For ease of understanding, we can broadly divide investments in the USA in four different categories:

- Financial markets and related products

- Real estate – All types

- Business and Start-up

- Second passport

- What are the applicable laws for Indian citizens who wish to invest in U.S. financial markets?

ANS: The RBI is responsible for regulating the outbound investment/remittance of funds by Indian citizens. The provision is made in the Foreign Exchange Management Act (FEMA) and regulations are made therein. There are two available options:

- Indian businesses having a company or partnership firm can invest up to 400% of the net assets of the Indian company for making an investment outside of India in a Joint Venture company (JV) or a Wholly Owned Subsidiary (WOS) without RBI permission under the automatic route. However, there are many terms and conditions attached and one must look closely at this provision, or better still, seek appropriate legal counsel.

- An Indian citizen can remit/invest up to $250,000 US in a variety of assets outside of India under the LRS scheme. The permissible capital account transactions by an individual under the LRS are:

- Opening of foreign currency account abroad with a bank

- Purchase of property abroad

- Making investments abroad – acquisition and holding shares of both listed and unlisted overseas company or debt instruments

- Acquisition of qualification shares of an overseas company for holding the post of Director

- Acquisition of shares of a foreign company towards professional services rendered or in lieu of Director’s remuneration

- Investment in units of Mutual Funds

- Venture Capital Funds

- Unrated debt securities

- Promissory notes

- Setting up Wholly Owned Subsidiaries and Joint Ventures

- How can one invest in U.S. financial markets?

ANS: There are a number of ways by which Indian citizens can make an investment in U.S. financial markets. Let me explain in brief:

- An Indian financial institute is providing some products to make an investment in the USA. Preferred for investments of $200,000 US and above.

- One may approach a U.S. licensed broker or financial advisor or portfolio manager and make an investment. Preferred for investments of $100,000 US and above.

- There are now online platforms (FinTech start-up) and American sub-brokers who have started arriving in the Indian market. They can assist in making investments in the USA with several facilities. Preferred for investors with smaller ticket size of $1000 US and above.

- There are platforms available where one can make Systematic Investment Plan (SIP) investment in global products with ticket size of only $200 US (similar to the Indian mutual fund market).

- There are also multi–stock market platforms available which can offer access to 50+ stock markets around the world from a single account. Suitable for ticket size of $500 US and above. However, the investor needs to perform his/her own transaction. A demo version is available to get acquainted with the platform. This is suitable for savvy investors who wish to save on brokerage. It is also recommended for Indian stock exchange brokers who can have a white label of this platform and offer their clients access to more than 50 stock markets globally right here in India.

- How is the U.S. financial market likely to fare post COVID-19?

ANS: As the COVID-19 outbreak gripped the entire world in March 2020, stock market prices plunged globally. Then, in a move that seemed irrational to some observers, the markets bounced back.

As per a leading economist, “Markets decline when there’s unexpectedly bad news and rise when there’s unexpectedly good news”.

Nevertheless, when we analyze the market sector wise, we see that certain sectors such as hospitality and travel are not doing very well and their stock prices are going down. On the other hand, tech companies are doing very well.

The dominance of major U.S. Tech Stocks in recent years has pushed the sector past another milestone as it is now valued at more than $9.1 trillion US, which is more than the entire European stock market, according to Bank of America global research.

In today’s complex economy, this once again confirms the view that stock markets are not the best indicators of a country’s economy. Therefore when it comes to investing in stock markets, one should look closely at individual sectors, individual companies and the factors that affect stock prices, rather than just looking at the overall market performance and indices.

- What is FATCA and how is it applicable to investments made in the USA?

ANS: The Foreign Account Tax Compliance Act (FATCA) is part of a broad initiative by the United States to combat offshore tax evasion by U.S. taxpayers. The goal of the law is not to increase revenues for the U.S. Treasury, but rather to collect information on U.S. taxpayers that invest in foreign financial institutions and foreign entities.

FATCA requires a U.S. withholding agent (generally defined as any U.S. party that is making a payment of interest, dividends, certain capital gains, etc.) to withhold 30% of a payment made to certain foreign entities.

Thus FATCA is more of a reporting requirement of the U.S. government. Thus if you invest in the USA, you will be required to file tax returns. When you sell your assets, there may be a withholding tax which may be claimed back by declaring a U.S. non-resident tax status or adjust against tax liability in India.

What are the opportunities for Indian stockbrokers in the USA?

ANS: There is a tremendous opportunity for Indian stock brokers in the USA and other financial markets of the world. Unfortunately, the Indian financial industry focuses on only one aspect of the economy, which is inbound investment.

Due to advances in technology, it is now possible to access not one but several stock markets of the world right from the comfort of your home or office with just a click. With some effort and will, it is easy to enter into these markets.

Just imagine – more than $19 billion US were remitted/invested by Indians outside of India with negligible advisory services from the Indian financial market and professionals.

If professionals associated with or working for the Indian financial markets take due interest and understand the importance of overriding the political and currency risk by investing in more than one country and in more than one currency, I have no doubt that this market can grow many folds.

I am more than confident that in a few years Indian investors will consider foreign investment as a mandatory part of their investment portfolio.

Indian stock brokers will benefit greatly by expanding their worldview and urging their clients to invest in markets outside of India. Proper understanding and knowledge of how this can be done is the need of the hour.

- How is the U.S. real estate market at present?

ANS: Just like the financial market, the U.S. real estate market is the backbone of the U.S. economy.

After six years of strong house price growth, the U.S. housing market is cooling. The S&P/Case-Shiller seasonally-adjusted national home price index rose by just 3.13% during the year to Q2 2019 (1.46% inflation-adjusted) – the lowest growth since Q3 2012. House prices increased 2.29% during the latest quarter (1.52% inflation-adjusted), according to S&P/Case-Shiller.

Despite this, 19 of the 20 major U.S. cities continued to experience moderate to minimal house price hikes, according to Standard and Poor’s.

The post COVID period has created some very good opportunities for repossessed properties.

At the same time, one must note that the USA is a country that attracts one of the largest foreign investment into real estate in the world. Foreign investment in U.S. real estate was almost $74 billion US in 2019. The three most popular states for foreign real estate investment in the USA are – New York and Florida on the east coast and California on the west coast.

How can one invest in U.S. real estate?

ANS: The RBI allows Indian citizens to make investments in foreign real estate. One can directly contact a real estate agent or developer in the USA and make an investment. There are many real estate agents and developers who come to India regularly to solicit investment in their projects.

The U.S. real estate market is highly regulated when it comes to selling and buying real estate but one still needs to be careful and seek professional help. One more important point that investors must note is that in the residential sector, only licensed real estate agents can assist in buying and selling real estate in the USA.

Abundant data is available on the internet pertaining to the U.S. real estate market. It is therefore very easy to obtain a lot of information online regarding the property under consideration.

- How can one decide which real estate to invest in?

ANS: USA is a very big market. Hence investors need to do their homework well. Deciding which state and city to invest in, how much to invest and personal preferences (house, condo, row house, downtown, suburbs) is generally influenced by the presence of family and friends in the USA.

A budget of $300,000 US can allow an investor to buy real estate in many states of the USA and it is a good starting point.

- Is it possible to obtain a mortgage for investing in real estate in the USA?

ANS: Yes, it is possible to obtain a mortgage for purchasing real estate in the USA from selected brokers who specialize in mortgages for foreign investors.

- How can one establish a business in the USA?

ANS: When it comes to establishing a business in the USA, there are two aspects to consider:

- Do you want your company to have a presence in the U.S. and hire local workforce?

In this case, a company, with only one director, can be registered in any state in the USA within four weeks. One can also obtain all types of tax ids and numbers.

Opening a bank account may require physical presence in the USA. This can allow you to perform business transactions and conduct business with U.S. companies. Understandably, one needs to follow annual company compliance and income tax filing.

- Do you want your company to have a presence in the U.S. and send workforce from India?

In this case, one needs to consider the U.S. immigration and visa rules. There are five types of visa categories can be covered under such a scenario –

- L-1A Visa – The L-1A nonimmigrant classification enables a U.S. employer to transfer an executive or manager from one of its affiliated foreign offices to one of its offices in the United States.

- L-1B Visa – The L-1B nonimmigrant classification enables a U.S. employer to transfer a professional employee with specialized knowledge relating to the organization’s interests from one of its affiliated foreign offices to one of its offices in the United States.

- EB-1 (c) – Certain managers or executives of multinational companies, who have been employed outside the United States for at least 1 year in the past 3 years preceding the petition can apply under this category. This category is known as ‘Transfer under the Mergers & Acquisitions’.

- E-2 Visa – The E-2 nonimmigrant classification allows a national of ‘Treaty Countries’ (Canada, Grenada, Turkey, and such other 60+ countries) to be admitted to the United States when investing a substantial amount of capital in a U.S. business.

- EB-5 Visa – The standard minimum investment amount has increased to $1.8 million US (from $1 million US) and, for the Targeted Employment Area (TEA), it has increased to $900,000 US (from $500,000 US) to account for inflation. The business also needs to create 10 jobs for Americans.

Each of these categories is very complex and needs extensive documentation, business plan and, in many cases, an elaborate explanation of the source of funds. Professional help and guidance is highly recommended and desirable when applying under any of these categories to ensure best results.

- One last question. Many of our members want their children to study in the USA. How can they plan for their children’s education the USA?

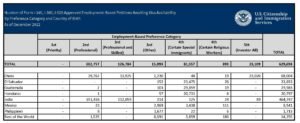

ANS: In general, when Indian students go to the U.S. for studies, they apply for a U.S. Green Card under one of the three following visa classes – EB1, EB2 and EB3.

There is a quota of 40,000 Green Cards per year in each category, with a total of 120,000 Green Cards to be issued.

When this quota was introduced, there were a limited number of foreign students applying for a U.S. Green Card. However, in recent times more and more foreign students are coming to study in the USA from all over the world and are applying for a U.S. Green Card after completing their studies. Thus the number of petitions have increased but the quota has remained the same since the last thirty years.

Due to an unprecedented increase in this number, the waiting time for a Green Card in October 2020 is almost 12 years. If one counts the period of study and H1 work visa period, the total period is almost 20 years to obtain a U.S. Green Card.

Indian students, and parents who wish that their children settle in the USA, need new strategies and proper planning if this dream has to come to fruition.

They must bear in mind the following points:

- Plan early and look in to the possibility of Residency by Investment. If that is not possible or feasible, look into the possibility of saving money for your child’s foreign education by investing outside India in financial markets or real estate to avoid currency fluctuation risk and the rising cost of foreign study.

- Parents and students must also realize that doing a Post Graduate Diploma (PGD..) in the U.S. is not equivalent to obtaining a Master’s degree.

- It is always preferable to study in a recognized university and not a college or private institute.

- In 2020, parents and students must not assume that studying abroad will guarantee job placement and future immigration.