Canada immigration for H1B visa holder, L1 visa holder and other visa class having temporary status in USA

Is your child, relative or friend facing a problem with H1B visa, L1 visa or any other visa in USA?

No worries. They can now breathe easy knowing that there are several options available to them to acquire legal status in USA. If they wish to move out of USA, they can also choose from more than 20 other countries around the world. This short video will give them all possible options:

- USA EB-5 investor program:

- Make an investment of 1,000,000 US$ in a new business and create 10 jobs or

- Make an investment of 500,000 US$ in a new business and create 10 jobs provided this business is in a TEA area or high unemployment area.

- Investment can be in form of Debt /Loan, Equity or fund.

Good projects can secure:

-your principal amount

-a good return and

– processing time is as short as 3 months to 13 months for the first I-526 petition approval.

- Canada skilled worker immigration:

You can qualify under this program if you have –

- A Master’s degree

- Minimum of 3 years of work experience

- Are preferably under the age of 35 years or better still, under 29 years of ageand

- Have an IELTS score of 8 in listening and 7 in each of the other three categories

- Start Up immigrant visa of Canada:

You can qualify for this visa if you have started a company that can be –

- Incubated by Canada Government approved incubators or

- If angel investors make an investment of 75,000 CD$ in your company or

- If a VC makes an investment of 200,000 CD$ in your company

- And if you have the required IELTS score and post-secondary education

- There are 10 different business immigration programs of Canada:

In general, you need to fulfil the following basic criteria for all of them –

- Possess net assets of 500,000 CD$ and above

- Have 2 to 3 years of business experience or senior executive experience

- Have a viable business plan to start a new business, purchase an existing business or enter into a joint venture with another company

- Have an IELTS score of at least 5 band in each category

- UK Tire 1 immigration:

To qualify under this program you need to have –

- Net assets of 200,000 pounds or more

- IELTS band of 4 to 5 in each category

- A viable business plan which will create 2 jobs

- Citizenship of Malta (EU member country):

If you wish to obtain the citizenship (passport) of Malta, a European Union member, you will need to –

- Make a donation of €650,000

- Purchase bonds of €150,000

- Purchase a residenceworth€350,000 or rent a residence worth€16,000 per year

Children under 26 years and parents can be included under this program

- Residency of Malta:

If you wish to obtain the residency of Malta, you will need to –

- Make a contribution of €30,000

- Purchase bonds of €250,000

- Purchase a residence worth€270,000 or rent a residence worth€10,000 per year

Children under 26 years of age and parents can be included under this program

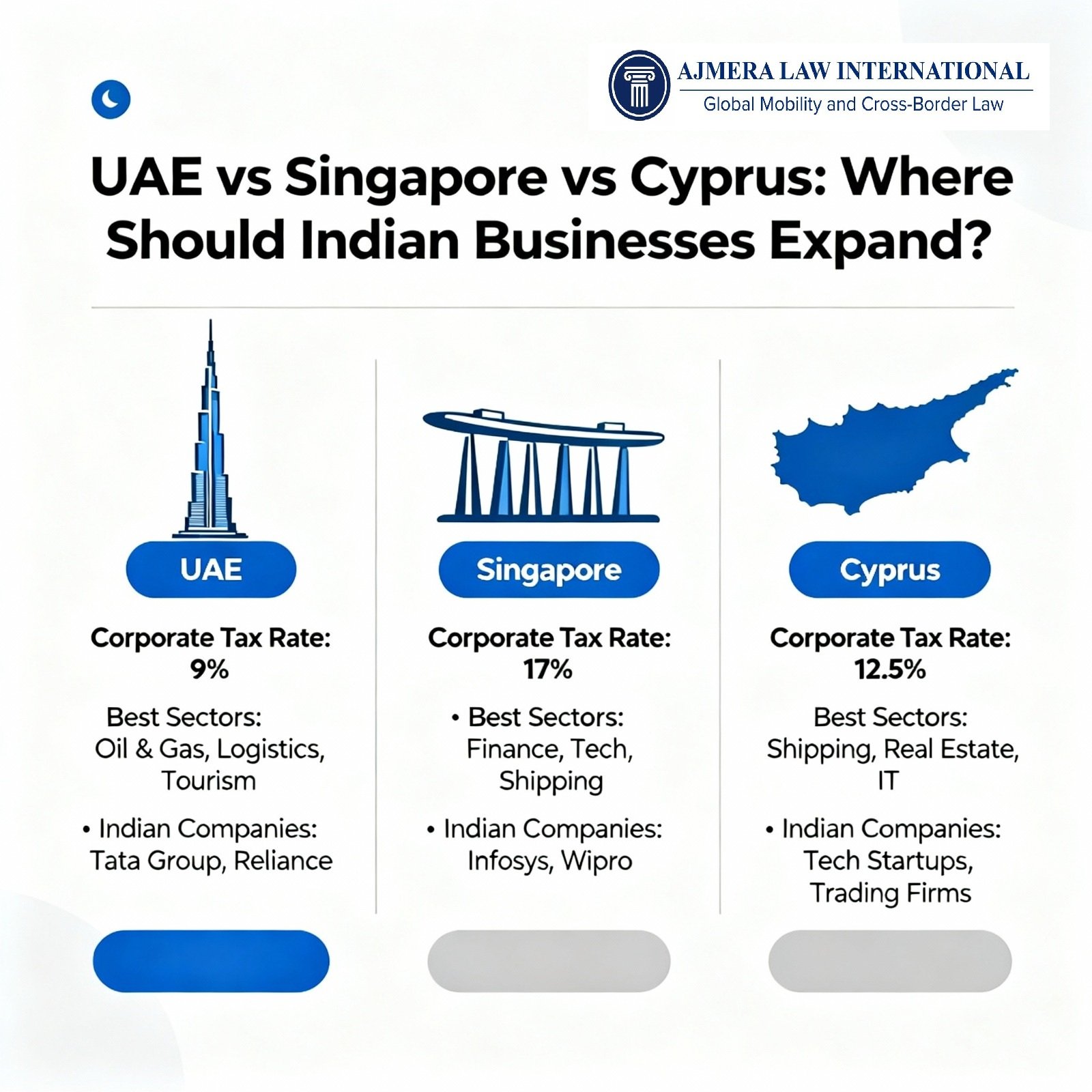

- Citizenship of Cyprus (EU member country):

If you wish to obtain citizenship of Cyrpus, an EU member country, you will need to-

- Purchase real estate/property worth€0 to 2.5 million

- Permanently maintain a residential property of €500,000 (you can sell other assets after 3 years)

Children under 25 years and parents can be included under this program. There are no language, minimum age and education requirements

- Residency of Cyprus:

If you wish to obtain the residency of Cyprus, you will need to –

- Purchase real estate/property worth €300,000

- Make a bank deposit of €30,000

- The applicant must provide proof of secured annual income of at least €30,000 outside of Cyprus. This income must increase by €5,000 for every additional child and €8,000 for each dependent parent.

Children under 25 years of age and parents can be included under this program. There are no language, minimum age and education requirements

- Residency of Greece (EU member country):

If you wish to obtain residency of Greece, you will need to –

- Purchase real estate worth €250,000 or more

Children under 21of age and parents included can be included under this program. There are no language, minimum age and education requirements. Under this program, applicants cannot work for someone but can operate their own business.Applicants can apply for Greek citizenship after 7 years

- Residency of Portugal(EU member country):

If you wish to obtain residency of Portugal, you will need to –

- Purchase real estate worth €500,000 or more (lesser amount investment possible)

Children under 18years of age and parents can be included under this program. There are no language, minimum age and education requirements. Applicant can work as well as operate their own business

- Residency of Spain ((EU member country):

If you wish to obtain residency of Spain, you will need to –

- Purchase real estate worth €500,000 or more

Children under 18 years of age and parents can be included under this program. There are no language, minimum age and education requirements. Applicant can work as well as operate their own business. Medical insurance is required.

- Second passport of Europe – Bulgarian Citizenship (EU member country):

If you wish to obtain a second passport and easy access to European markets, you can opt for Bulgarian citizenship. To qualify, you will need to –

- Invest €500,000 for Permanent Residence in government bonds

- Invest €1 million for Citizenship in government bonds

Loans are available for making the required investment. Upon approval, applicants can live, work, operate a business and study for free/with reduced fee in any member EU country.

- Citizenship of Dominica in 3 months:

If you wish to obtain citizenship of another country in a short period of time in a hassle-free manner, you can apply under Dominica’s Citizenship & residency Program. To qualify, you will need to –

- Make a donation of $100,000 US or more OR

- Make aninvestment in real estate of $200,000 US or more for 3 years

Children under the age of 30 years, parents above 55 years of age &grandparents can be included under this program. There is no taxation on income earned abroad and one can obtain NRI Status plus visa free travel to more than 120 countries around the world. Easy access to medical schools in USA for children

- Citizenship of Grenada in 3 months:

If you wish to obtain citizenship of another country in a short period of time, you can apply under Grenada’s Citizenship & residency Program. To qualify, you will need to –

- Make a donation of $200,000 US or more OR

- Make an investment in real estate of $350,000 or more for at least 5 years

Children under the age of 29 years and parents above 55 years of age can be included in the application. There is no taxation on income earned outside of Grenada and one can obtain NRI Status plus visa free travel to more than 120 countries around the world. Easy access to medical schools in USA for children and E2 Business visa of USA.

- Citizenship of St Kitts and Nevis in 2 months:

If you wish to obtain citizenship of another country in a short period of time, you can apply under for citizenship of St Kitts & Nevis. To qualify, you will need to –

- Make an investment of at least $400,000 US in one of the approved real-estate developments OR

- Make a donation of $250,000 US to the Sugar Industry Diversification Foundation (SIDF, a public charity)

Children under the age of 30 years and parents above 55 years of age can be included in the application. There is no taxation on income earned outside of the island country and one can obtain NRI Status plus visa free travel to more than 150 countries around the world. As a Commonwealth citizen, applicant receives certain preferential treatment in the United Kingdom. Two or more applicants may apply for citizenship together by purchasing one piece of real estate.

- Citizenship of Antigua & Barbuda in 3 months:

You can obtain second citizenship or a second passport of this beautiful island nation within a short period of time. To qualify, you will need to –

- Make a contribution to the National Development Fund of at least $100,000 US OR

- Make an investment in designated, officially approved real estate with a value of at least $400,000 US OR

- Make an investment in an approved business of at least $1,500,000 US

Dependent children and dependent parents over 65 years of age can be included under this program. There is no minimum net worth requirements or previous business experience needed. Visa free travel to more than 135 countries around the world. No taxation on income earned outside of St Kitts & Nevis

- Citizenship of St Lucia in 3 months:

You can obtain second citizenship or a second passport of this beautiful island within three months. To qualify, applicant will have to –

- Choose from four options which range from an investment amount of $100,000 US to $3,500,000 US. These four options are –

- Saint Lucia National Economic Fund

- Real Estate Projects

- Enterprise Projects

- Government Bonds

Dependent children under 25 years of age, dependent parents above 65 years and mentally or physically challenged dependent children and/or parents can be included under this program. Visa-free travel to over 120 countries around the world. No taxation on income earned outside of StLucia. Under the Enterprise Project option, two or more applicant can make a minimum investment of $6,000,000 US, with each applicant contributing no less than US$1,000,000.

- Business Immigration to New Zealand:

You can apply for conditional business residency of New Zealand. To qualify you need to –

- Invest $100, 000 NZ in capital investment and run a business for 2 years OR

- Invest $500,000 NZ in capital investment and run a business for 6 months

- Have a business plan that will help NZ economy

- Be fluent in English and serious businessmen only

After obtaining a business permit, applicant can apply for Permanent Residence of New Zealand after 3 years.

- Investment immigration to New Zealand – $3 million:

You can apply for direct PR of New Zealand through investment. To qualify, you will need to

- Have $3million NZ in available assets

- Invest $2.5million NZ in real estate

- Have 3 years of business/management experience

- Have basic English skills (IELTS 3 band or equivalent)

- Be under 65 years of age

- Investment immigration to New Zealand – $10 million

You can apply for direct PR of New Zealand through investment. The highlights of this program are –

- Must have $10million in available assets

- There is no age requirement

- Can invest in a variety of assets class

- No minimum residency requirements

- Business Immigration to Australia – Business Visa Class (188A):

You can apply for temporary PR of Australia. To qualify, you will need to –

- Have a business turnover of $500,000 AU and 30% (private company) or 10% (private limited company) ownership

- Have net assets of $800,000 AU

- Have a business turnover of $300,000 AU in Australia

- Manage a business in Australia for 2 years

- Business Immigration to Australia – Investor Visa Class (188B):

You can apply for temporary PR of Australia. To qualify, you will need to –

- Have net assets of $2.25 million AU

- Own and manage a business of $1.5 million AU

- Invest 1.5 million AU in governmentbonds

If you keep your investment for 4 years and have minimum residency for 2 years, you can be eligible for permanent PR and citizenship after 5 years.

- Business Immigration to Australia – Significant Investor Class (188C):

You can apply for temporary PR of Australia. To qualify, you will need to –

- Invest $5million AU in Australia (various options available)

- Stay 160 days in 4 years in Australia to get permanent PR

- No age limit

- Business Immigration to Australia – Business Talent – Significant Business History (132A):

You can apply for direct PR of Australia. To qualify, you will need to –

- Own & manage a business with a turnover of $3 million AU

- Have ownership of 30% (private) or 10% (public) in the company

- Have net assets of $1.5 million AU that can be transferred to Australia

- Invest$400,000 AU in Australia