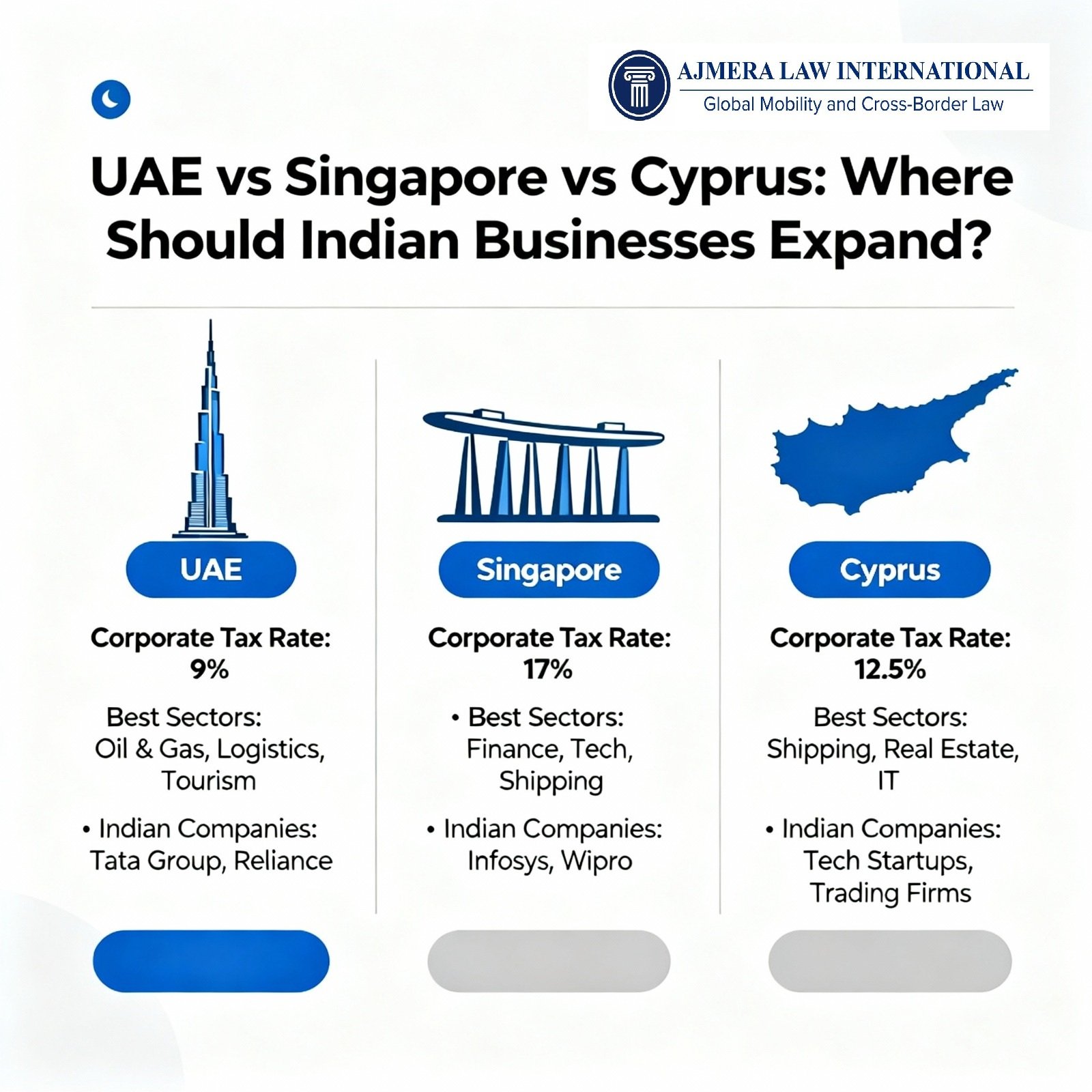

Where Indian businesses should expand their business?

UAE vs Singapore vs Cyprus?

Comparative Guide for Indian Businesses

Setting up an international company requires choosing the best jurisdiction for your sector, strategy, and compliance needs. For Indian entrepreneurs, the UAE, Singapore, and Cyprus are leading options, each with distinct advantages. Below is an expert comparison including easy-to-read tables.

Here is a Comparison Table

| Feature | UAE | Singapore | Cyprus |

|---|---|---|---|

| Corporate Tax Rate | 9% (above AED 375k); often 0% in Free Zones | 17% (effective rates lower for startups) | 12.5% (2.5% IP income, EU lowest) |

| Ownership | 100% in Free Zones; partial on mainland | 100% foreign allowed | 100% foreign allowed |

| Legal System | Civil law (Sharia elements) | English common law | English common law (EU) |

| Tax Residency/Structuring | Easy residency setup via company; Golden Visa possible | Resident director needed; high compliance | Quick EU residency; Schengen access |

| Banking & Reputation | Good regional, improving global; some controls | Tier-1 global banks, top reputation | EU banking, AML compliant, strong reputation |

| Market Access | Middle East, Africa, South Asia | Asia-Pacific, ASEAN, global | EU, Mediterranean, Schengen, IMEC route |

| Startup Ecosystem | Growing, especially in Dubai/ADGM | World-class, ranked top 4 globally | Fast-rising, supports tech/finance/holding |

| Ideal For | Asset-heavy, trade, retail, logistics, real estate, energy | Tech, fintech, finance, regional HQ | Holding, fintech, shipping, IP, EU expansion |

| Residency via Company | Yes, quick and flexible | Yes, but local director required | Yes, quick setup |

| Minimum Substances | Requirements in free zones flexible | Local presence and director needed | Substance needed for EU/treaty compliance |

| Indian Company Examples | TCS, Tata Motors, Malabar Gold, Lenskart, Nykaa, Himalaya Wellness | Tata Group, Reliance, Infosys, Flipkart, Practo, Crayon Data | Thomas Cook, LTIMindtree, Bao Financial, NPCI UPI, BCentriqe AI |

Which Destination Suits Your Company Type?

| Sector | UAE | Singapore | Cyprus |

|---|---|---|---|

| Tech & Digital Services | Growing, esp. DIFC/ADGM | World-class hub, best for regional HQ, R&D | EU access, IP box, fintech |

| Real Estate/Construction | Strongest (Dubai/Abu Dhabi) | Modest, not a main sector | Growing in Mediterranean/Europe |

| Trade/Logistics | Strong (Dubai, JAFZA) | Excellent (ASEAN gateway) | Major EU gateway, shipping |

| Energy & Commodities | Leading (oil/gas focus) | Modest | Clean energy, Mediterranean access |

| Holding/Investment Fund | Good FEZ options | Good, global mobility | Best for EU funds, tax efficiency |

| Retail/Luxury | Booming market | Emerging sector | Tourism, niche luxury |

Why Each Country Attracts Indian Businesses

UAE: Regional hub for trade, retail, logistics; easy residency; 0% personal tax; prestige locations; ideal for expansion to MENA & Africa.

Singapore: Asia HQ for tech, financial services, startup innovation; excellent compliance; funding and scaling support; quick registration.

Cyprus: EU single market access; lowest EU corporate and IP tax; holding and fintech-friendly; Schengen zone; legal clarity and reputation for Indian family offices and investment groups.

Examples of Indian Businesses Present

| Jurisdiction | Indian Companies/Groups |

|---|---|

| UAE | TCS, Tata Motors, Malabar Gold, Lenskart, Himalaya Wellness, Nykaa, Jindal |

| Singapore | Tata Group, Reliance, Infosys, Flipkart, Practo, Wipro, InMobi, Crayon Data |

| Cyprus | Thomas Cook India, LTIMindtree, Bao Financial, NPCI UPI, BCentriqe AI |

In Summary

UAE is best for Indian corporates in trade, logistics, energy, and retail; Singapore leads in tech, finance, and APAC headquarters; Cyprus is the EU gateway for holding, IP, fintech, and is increasingly favored for EU market entry and family office structuring.

For personal guidance tailored to your sector and business plans, contact: Lawyer Prashant Ajmera, Ajmera Law International – Global Mobility & Cross Border Law

info@ajmeralaw.com | +91 99742 53030