“Indian Investors Welcome to Invest Abroad at Their Own Risk

Government Shows No Intention to SafeguardsIndian Investors”

In light of the changing demands of businesses in India within an increasingly interconnected global market, it is essential for Indian corporations and citizens to participate in the global value chain.

The revised regulatory framework for overseas investment aims to simplify the existing framework and align it with current business and economic dynamics. This introduction of “Overseas Direct Investment” and “Overseas Portfolio Investment” under the Foreign Exchange Management Act (FEMA) has shifted various overseas investment transactions from the approval route to the automatic route, significantly improving the ease of doing business.

However, these regulations, rules, and past provisions have failed to adequately protect Indian investors and consumers by regulating foreign professionals and businesses who wish to attract Indian investors.

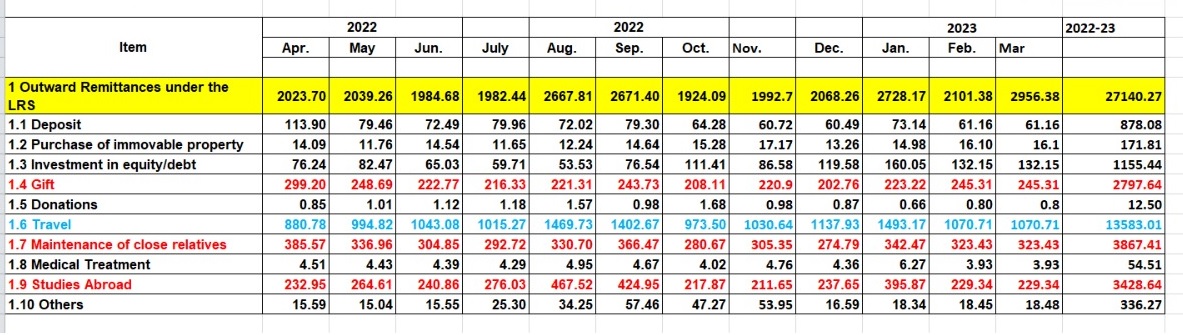

Since 2007, Indian companies and citizens have been engaging in outbound investment, with last year’s Reserve Bank of India (RBI) data indicating significant investments and remittances by Indian citizens of US$ 27 Billion and over $4 billion in investments per month by Indian corporations outside of India.

Given the size of the Indian market, it has attracted a large number of foreign professionals and companies who regularly visit or establish offices in India without any restrictions or regulatory licensing requirements.

“Disparity in Professional Licensing Regulations: Foreign Professionals Operate Without Restrictions in India, while Indian Professionals Face Stringent Regulation”

Let’s examine some real examples of the absence of licensing requirements for foreign professionals and companies aiming to attract Indian investors:

- Foreign Financial Advisors and Brokers:

According to RBI data from the previous year (2022-23), Indian citizens invested US $1155.44 million in foreign equity and debt products. Over the past 5-7 years, numerous foreign brokers and financial advisors have either visited India to attract Indian investors or established offices in India without any regulatory or licensing requirements from SEBI, RBI, or any state or central government agency.

Foreign professionals’ approach is straightforward: they find Indian citizens who will market their services in India, and these individuals are asked to register a company and rent an office in a business canter to initiate their operations in India.

Conversely, Indian citizens wishing to practice as financial advisors or professionals or MFDs need to obtain a license from SEBI as one of the licensed intermediaries. Recently, SEBI has taken strict action against many Indian citizens providing financial advice through social media platforms.

However, SEBI and RBI have completely disregarded foreign financial advisors, brokers, and companies that open offices or visit India regularly to attract Indian investors. If these foreign financial advisors and companies engage in fraud or misrepresentation with Indian investors, there are no remedies available to the Indian investors.

2.Foreign Real Estate Developers and Brokers:

RBI data on foreign remittances for the years 2022-23 reveals that Indian citizens invested US $171.81 million in foreign real estate.

A considerable number of foreign real estate developers and brokers frequently visit India and open offices to market foreign real estate projects and properties in the country. When these developers visit India, no questions are asked about their marketing activities, and their projects are often endorsed by Indian celebrities. Many developers from neighboring countries have already established offices in India, with more on the way.

However, if you are an Indian real estate developer or broker, you are subject to the Real Estate Regulatory Act (RERA), and your projects must be approved by the respective state’s RERA authority. Even Indian real estate brokers must register with RERA.

It is puzzling why there is a double standard when it comes to marketing foreign real estate projects to Indian investors or consumers. Are we presuming that all foreign projects are safe and require no regulation, or are we waiting for another significant scandal to occur?

Foreign real estate developers either visit India or open offices with the help of Indian citizens who register companies with the Registrar of Companies (ROC) in the respective states in India. The ROC does not question the nature of their business, allowing these companies to enter the Indian market without any restrictions.

Many foreign companies genuinely interested in attracting Indian investors are surprised to discover that they can enter the Indian market without requiring any government approval. They can conduct seminars in five-star hotels and directly engage with Indian consumers.

3. Foreign Lawyers Operating in India

Although the Indian Advocates Act of 1961 clearly states that only Indian lawyers licensed with the State Bar Council can provide legal services in India, some foreign lawyers have found a way to circumvent this restriction. They register a company in India with the Registrar of Companies (ROC) and enter the Indian market without any regulatory requirements. The Bar Council of India (BCI) and state bar councils have also failed to regulate or take action against these foreign lawyers operating in India in spite of the Supre Court judgment in this matter.

It is also worth noting that some foreign governments have issued licenses to practice specific areas of foreign law to Indian citizens who are not Indian lawyers or advocates. This is also a violation of the above law and no action from the respective government agency.

Additionally, many foreign-regulated legal consultants visit India or open offices in the country, even though they are not Indian lawyers or advocates. These foreign legal professionals boast about being licensed in their respective countries.

However, the question remains: if Indian consumers are defrauded by these foreign-regulated legal consultants or foreign lawyers, what remedies do they have other than filing a First Information Report (FIR) or making a police complaint?

4. Foreign Education Institutes Recruiting Indian Students:

In India, starting an educational institute at the school or post-secondary level requires complying with regulatory requirements to protect Indian students and their families from becoming victims of fraud and ensure they receive a quality education at a reasonable cost.

However, if you are a foreign educational institute, you can come to India, market your institute, associate with student visa agents or consultants, and start recruiting Indian students without facing any restrictions or requirements. There is a lack of regulations and reduced requirements for foreign education institutes and Indian education and visa consultants.

Many of us may remember the foreign recruitment fraud in the early 1970s and 1980s from several neighboring countries. This compelled the Indian government to regulate foreign recruiters in India by implementing the Emigration Act of 1983.

Considering the numerous instances of foreign education-related fraud in 2017 and 2018, the Minister of External Affairs at that time introduced the Emigration Bill 2019 to regulate foreign education institutes and Indian student visa consultants. However, due to COVID-19, this bill could not be implemented, and a revised Emigration Bill 2021 was enacted, which removed provisions to regulate foreign education institutes and Indian immigration and student visa consultants.

In response to a question posed by a Member of Parliament in the Indian parliament, the respective ministry stated that they receive two complaints per day regarding foreign education and visa fraud. Despite the abundance of such stories in both online and offline media, the authorities concerned have chosen not to take action to protect Indian consumers and citizens.

In conclusion, according to RBI data for the years 2022-23, the total foreign remittance and investment in the aforementioned categories amount to US $27 billion (approximately Rs. 221,859 crores). However, there is no regulatory framework in place to regulate foreign professionals and businesses aiming to attract Indian investors, leaving Indian consumers without adequate protection.

About the Author:

The author of this article/blog is Prashant Ajmera, an Indian immigration lawyer and the founder of Ajmera Capital. He has been a Canadian citizen for the past 30 years and is also the author of two books: “Millionaire of the Move” and “How to Plan for Your Child’s Foreign Education: Myth vs. Reality”. He has been assisting and advising parents o the subject of Financial Planning for Foreign Education. Consult us